6 Tips To Select The Right Mortgage Underwriting Support

Introduction

The mortgage underwriting process is crucial in the home loan approval process. It involves assessing the borrower’s creditworthiness, analyzing financial documents, and determining the level of risk associated with granting a mortgage.

Many mortgage lenders and financial institutions seek external support to streamline this process and ensure accurate and efficient underwriting. However, choosing the proper mortgage underwriting support can be a daunting task. This blog will explore six tips to help you select the appropriate mortgage underwriting support for your needs.

Understand Your Requirements

Before selecting a mortgage underwriting support provider, it is crucial to have a clear understanding of your specific requirements. Determine the volume of mortgage applications you handle, your desired turnaround time, and any specific regulatory or compliance requirements. Knowing your needs will help you identify a support provider that can effectively meet your expectations.

Experience and Expertise

Mortgage underwriting is a complex process that requires a deep understanding of lending regulations, risk assessment, and financial analysis. When evaluating potential underwriting support providers, consider their experience and expertise in the mortgage industry. For any kind of support, it is best to look for mortgage underwriting Support services. Look for companies with a proven track record of delivering high-quality underwriting services and a team of skilled underwriters well-versed in the latest industry practices.

Technology and Automation

Efficiency and accuracy are paramount in mortgage underwriting. Assess the technological capabilities and level of automation offered by the support provider. Look for companies that leverage advanced technologies, such as artificial intelligence and machine learning, to streamline the underwriting process. Automation can reduce manual errors, improve turnaround time, and enhance the overall efficiency of the underwriting process.

Compliance and Risk Management

Compliance with regulatory guidelines is crucial in the mortgage industry. Ensure the underwriting support provider you choose follows all relevant laws and regulations, including the Consumer Financial Protection Bureau (CFPB) guidelines.

Additionally, inquire about their risk management processes to ensure they have adequate measures to mitigate potential risks associated with mortgage underwriting.

Data Security and Confidentiality

Mortgage underwriting involves handling sensitive and confidential borrower information. Data security should be a top priority when selecting an underwriting support provider. Inquire about their data protection measures, including encryption protocols, secure file transfers, and employee training on data privacy.

Ensure that the company adheres to industry-standard security practices to safeguard borrower information. When assessing data security and confidentiality measures, ensure that the underwriting support provider implements secure file transfer protocols, such as SFTP (Secure File Transfer Protocol) or FTPS (FTP over SSL/TLS).

These protocols encrypt data during transit, preventing unauthorized access. Additionally, please inquire about the provider’s data storage practices, including whether they employ secure servers and robust access controls to protect sensitive information.

Customization and Scalability

Every mortgage lender has unique requirements and may experience fluctuations in loan volumes. Flexibility, customization, and scalability are vital factors when selecting an underwriting support provider. The best companies provide Mortgage Loan Processing Services. One just needs to figure out the perfect companies for the job.

Ensure the company can tailor its services to your needs and accommodate changes in your loan volume without compromising quality or turnaround time. By choosing a flexible and scalable underwriting support provider, you can expect a tailored and responsive service that aligns with your unique requirements and allows seamless adjustments as your business evolves.

Conclusion

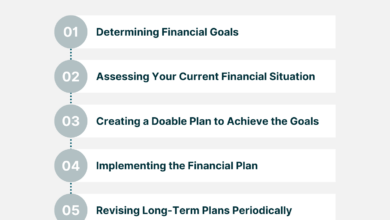

Selecting the right mortgage underwriting support provider is critical for lenders looking to streamline their loan approval process. By considering these six tips – understanding your requirements, assessing experience and expertise, evaluating technology and automation, ensuring compliance and risk management, prioritizing customization and scalability, and emphasizing data security and confidentiality – you can make an informed decision that aligns with your organization’s goals. Remember, a reliable underwriting support provider can enhance efficiency, reduce risks, and ultimately contribute to the success of your mortgage lending operations.