When You Should Seek Help from a Financial Advisor

If you are serious about acquiring long-term wealth, you’ll undoubtedly meet or seek help or advice from a financial planner. You might prefer to manage finances on your own, but there are occasions when doing so is a mistake. People often believe that an insurance company might hire a planner to steer them into investments marketed by that firm. On the other hand, an intelligent financial advisor will not offer you the advice to earn a commission.

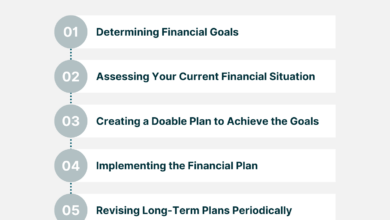

However, a good adviser will listen to your goals, assess your present financial situation, and provide recommendations on actively managing your money moving ahead. While you don’t need to regularly engage with a financial advisor, there are instances when financial check-us and consultation are beneficial.

If You Have Earned a Salary Increment

A promotion at work is usually a cause for celebration. However, once the initial thrill has worn off, the question of what to do with all those extra dollars remains. If you have debts or responsibilities to pay off, you might use your excess money toward them. If you are confused about what to do with the additional cash, a financial professional can assist you. A financial adviser might help you use the big raise you earned to enhance your long-term wealth rather than utilize it for short-term needs, based on their years of experience.

When You Acquire Your First Salary Job

Regardless of whether it earns you little or a lot of money per year, your first job is a solid reason to consult a financial advisor. They can advise you on how to start saving for retirement and how to get the most out of your employee’s compensation package.

Lower Your Tax Liability

A rise in your salary, a change in the tax system, or even the sale of a capital item such as a building or a piece of land might push your income into a higher tax bracket. If this occurs, it may be a good idea for you to contact a financial counselor to discover how to lower your tax liability. Even though you may be aware of significant tax-saving components such as section 80C deductions, a financial professional can assist you in taking advantage of all the benefits available for your taxpayer profile to reduce your tax bill.

Change in Marital Status

When you enter or leave a marriage, it’s also a perfect moment to get advice from a financial advisor. Inviting a neutral party can assist limit financial losses in a divorce and make it simpler for engaged couples to discuss pooling income and assets in the marriage.

Planning on Retirement

One area where financial advisors excel is retirement planning. Meet with a planner far ahead of your intended stop date to get the most out of their guidance. Your retirement approach should be straightforward the younger you are. However, when you enter your 30s and 40s, you’ll better understand what you want out of retirement and figure out how to get there. Financial experts can help you determine how much you should save and where you should invest in putting you on track for your ideal retirement.

When You’re Getting Ready to Pass on Your Assets or Property

You and your assets will part ways in the future. Once you start thinking about estate planning, it’s a good idea to consult with a specialist. A financial advisor can help you reduce estate taxes, arrange for last costs, and examine account beneficiary information. Also, if you are selling an inherited property in Florida or any other location in your area, having a financial advisor can help you since the process can be emotionally draining.

If You’re Drowning in Debt

Anybody who has been bankrupt, whether from credit cards or student loans, understands how difficult it may feel at times. Especially if you are also trying to save for retirement or other financial objectives or live in a high-cost city. If you’re feeling overwhelmed by your debt, talk to a financial advisor about creating a debt payback plan that works for you while keeping your other financial objectives in mind.

Clothing Thoughts

Managing your own money and financial objectives may be difficult and intimidating. As a result, enlisting the help of a professional might help you feel more in control and less stressed. And by collaborating with a financial advisor, you may achieve your financial objectives and financial independence.

Read More: Four Key Financial Tips for Small Businesses