Why It’s Time To Move On From Traditional Accounting Methods To New One

The need of the hour is to shift to a platform that is quick, safe, can be accessed from any place and eases the work within the organisation. Many businesses are shifting their entire work from traditional accounting software to cloud-based accounting software, depending on their needs and requirements.

The shifting ones have faced several issues while using traditional accounting software. If you are facing similar issues, it’s time to move from traditional accounting methods to a new one.

Issues In Traditional Accounting Software

- Data entry errors – Traditional accounting software can result in data entry errors due to human negligence. Sometimes labour is forced to enter the data in fatigue, resulting in incorrect input. Moreover, if the data gets misplaced, the entire information must be inserted twice, which can be time-consuming. Therefore, installing computerised accounting software can eliminate errors up to a significant amount. If not eliminated, it can reduce errors and help track them effortlessly.

- Extensive cost – Traditional accounting software is costlier as the organisation needs to pay the labour, bring physical inventories and acquire space to keep all the records. If the company’s funds are less, traditional methods can prove costly to them. On the other hand, cloud storage or other computerised accounting software are one-time investments. They will be successful and prove profitable in the long run as they will fit the organisation’s requirements.

- Speed – Accounting software these days not only processes data and creates reports at a rapid pace than traditional accounting software but also allows one to enter and manage data more conveniently with fewer errors. Present-day accounting software saves a lot of time by allowing various documents to be printed and assembled quickly, such as payrolls, purchase orders, receipts, invoices, and many more.

- Accuracy – Traditional accounting software is tedious to handle. Manually handling data, inputting the information, and doing calculations can be hectic if your organisation is large enough with numerous employees. Computerised accounting software eases out these types of tasks. It will allow you to improve inventory management and take control of the payment collection, saving time and improving cash flow. Moreover, the errors while inserting the data will be reduced drastically.

- Automation – Adding columns manually and accurately, then double checking your work, along with writing the numbers physically, can overburden you at any time. Manual accounting software is not great for performing daily tasks with 100% accuracy and concentration. Hence, the need for computerised accounting software is there, which can update records automatically and allow everyone to get access instantly. If the calculations are done automatically, time and energy will be saved. Most importantly, errors will be reduced.

- Reporting – Traditional methods take time to locate the information as the data needs to be compiled to generate a particular report. What happens if the data is not retrieved properly? To eliminate this tedious process, automatic accounting software should be installed at the office premises. This software will automatically pull all relevant ledger entries and provide instant reports on profit and loss, stock evaluation, payable reports and many others.

- Integration of accounting with other business processes – Traditional accounting is not an isolated process. It is an interconnected business process in which transactions are bound to affect different processes. Whenever you record a transaction, other ledgers get affected. Hence, automatic accounting software will come in handy to keep a check on all these transactions. For instance, if you want to take data of the entered amount, you cannot do it manually over a heap of data. For that, you need automated accounting software.

- Backup – Traditional accounting software does not have any backup. If the files are lost, they are lost forever and cannot be easily located. You cannot keep paper records safe for a long time as bugs and mites might destroy them. Digital accounting software is quicker to recover the loss and create a backup of crucial information. Any organisation can rely on digital accounting software in case of a mishap.

- Data storage, security and management – Storing a large amount of data physically requires more space and effort to assemble the files. The ledger books can be compromised as the business owner needs to place them in a safe place if the information is confidential. To keep files safe and secure, digital accounting software can be used. Password-protected files are less easy to crack, and the owner will stay relaxed without worrying about stealing data.

- Change in the business environment – Modern businesses have become less dependent on traditional methods to manage their finances. They are acquiring all sophisticated technological products that can boost their efficiency and help them stay strong in the competitive market. For a high turnover business, it is mandatory to solve the problems with the help of digital accounting software and incorporate measures that can accurately solve the pain areas.

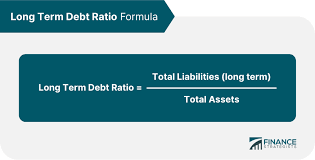

- Accounting measurement problems – Traditional accounting software can provide misleading information if the data isn’t inserted properly. For example, if a person studies data and concludes that it is profitable, but in reality, it isn’t true, then the company can suffer in the future due to this error. Keeping valid digital records and allowing computers to track the information will help better account calculations, which will be correct.

- Changing accounting practices – Many companies are confronting issues due to changes in accounting techniques and methodologies. Relying on traditional accounting software cannot help for a longer time. Therefore, to manage the business with adequate labour cost, inventory build-up and efficient business practices, it is mandatory to bring digital accounting software.

In A Nutshell

You have gone through why it is important to shift from traditional accounting software to a new one, which is more payable, reliable, can track outstandingly, and report everything quickly and timely. Moreover, taking care of your savings by investing in good accounting software is necessary. If you want to make your business more efficient and focus on its growth, then look at various accounting software UK and choose wisely. Lastly, ensure it stays compliant, which is the need of the hour in light of recent happenings in the finance world with respect to error and safety.

Apart from this, if you want to know about DaaS enhance QuickBooks Performance then please visit our Software category