What Is P2p Lending, How You Can Make Money From It

Peer to peer lending attracts lenders due to high-interest rates and several other benefits. It looks like magic that is offering high interest in a low-interest-rate environment from the outside. Investors may wonder how some loans can offer such high returns, who are using these loans and what is happening behind the scenes. But when we look closer, we can see that there is a lot happening behind the scenes, and it is not magic to earn high returns from p2p loans. There are facts and explainable reasons for how this alternate lending works and provides higher returns than traditional investments. This post will explain all the things necessary to understand peer topper investment and describe how you can make money from it.

What Is P2p Lending?

Peer to peer lending is a way of lending money to individuals in need of money to fulfil their needs. You act as a bank in this lending and get profit in the form of the interest rate that borrowers pay on each loan. There are online platforms that act as a middleman between you and borrowers. P2p platforms do all the hard work for you, such as making sure the borrowers are making timely repayments, you are getting regular interest rates, and they also chase for the late or missed repayments. These platforms operate online, so the overhead charges are lower than banks. In addition, p2p platforms accept more applications and offer loans to individuals or companies with low credit scores.

How Does P2p Lending Work?

P2p lending is different from traditional lending, and it works differently for investors and borrowers. If you want to become a p2p investor, you have to choose a platform and create an account as an investor. Once your account is created, deposit an amount you want to invest. That money is then lent to the potential borrowers at predetermined interest rates and loan terms. As an investor, you can invest in different types of loans, including personal loans, business loans and p2p bridging loans. On the other hand, if you want to borrow money from p2p platforms, register yourself as a borrower and provide all the necessary information. Then, the platform will assess you to make sure that you are creditworthy and afford to repay the loan.

Most p2p loans are unsecured, which is why investors find it a risky option. Different p2p platforms have different models, but every platform takes all the necessary measures to ensure that the borrowers are creditworthy and they can repay the loan amount. However, when you invest in p2p property loans or bridging loans, you have fewer chances of losing money because these loans are secured against a valuable asset of the borrower. Furthermore, if a borrower defaults, the platform has a right to sell the asset and get the money back.

Advantages Of P2p Lending

Peer to peer lending offers numerous benefits to investors. Here are some of the benefits that can help you in understanding why you should make it a part of your investment portfolio.

Attractive Returns

The returns on p2p loans are higher than the traditional bank loans or other investments. If you invest wisely, you can even earn double-digit returns. Some platforms offer 14 to 16% returns per annum which is much higher than conventional investments and bank saving accounts.

Liquidity

In the beginning, p2p investment was not as liquid as it is today, and you had to wait for the loan terms to end to get your money back. But now, most platforms have a secondary market where you can sell your loans to the interested investors if you want to withdraw funds before the end of loan terms. However, you may have to wait to find an investor who is willing to purchase your loan.

Safety

P2p platforms are responsible for conducting credit checks before granting loans to them. All the platforms take necessary measures to ensure that the borrowers can repay on time. It is much safer than lending money to strangers yourself without any credit assessment. In addition, when you invest in a p2p bridging loan.

Diversification

One significant benefit of p2p lending is that it provides investors with an opportunity to create a diversified portfolio. You can add p2p loans to your existing portfolio and also create diversification within your p2p portfolio. In addition, P2p platforms allow you to invest in multiple loans and choose borrowers with varying credit profiles. This way, you can mitigate the risks associated with borrowers’ default.

Low Maintenance

If you want to invest in p2p loans, you do not need to go to any traditional financial institutions. Instead, you can create an online account at a p2p platform and start investing money. Thus, you can manage your p2p portfolio from anywhere by signing in to your account.

Easy To Start

You do not need a huge amount of money to start a p2p investment. The initial investment you require can vary from platform to platform, but usually, you can begin from £100. Moreover, p2p bridging loans provide you with ease and the opportunity to invest in property without having a huge investment.

Disadvantages of P2p Lending

You must be aware of the drawbacks of p2p investment to make a better decision.

Risk Of Default

The most significant risk is the risk of losing money when a borrower fails to repay the loan amount. Most loans are unsecured, so the risk of losing money is high.

Shorter History

P2p lending is a relatively new investment, so the p2p platforms do not have a long track record like the stock market or other traditional investments.

If you need to withdraw funds quickly, it is not possible because you have to sell your loans in the secondary market or wait for the loan terms to end.

Is It Safe To Invest In P2p Loans?

When you choose a reliable and well-reputed platform, peer to peer lending is safe. The government schemes like the Financial services compensation scheme do not protect you, so you have to be careful when choosing a p2p platform. Always select a platform that is transparent in rates and statistics and also publishes regular updates.

When you invest in p2p loans, there are chances of borrowers defaulting, and platforms can not cover the loss completely. Of course, with a trustworthy platform, the probability of losing money is not high, but still, it is also not zero.

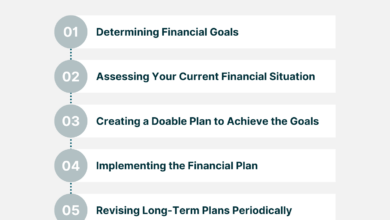

How To Start P2p Investment

It is straightforward and easy to start a p2p investment and make money from it. Select a platform and create an account as an investor. Once your account is created and verified, deposit funds and start lending. You can set investment criteria and choose the loans and borrowers you want to lend money to. Some platforms also have an auto investment in which you do not have to choose borrowers manually, and the platform spreads your investment across multiple loans according to your set criteria. You can get a profit in the form of interest when borrowers repay the loan amount.

Bottom Line

P2p lending can be a source to make regular income when you invest wisely and take all the measures to mitigate risks. You have a variety of loans such as personal loans, business and bridging loans to invest and create a diversified portfolio. With this diversification, the risks are reduced, and you can get maximum returns. In addition, do research and choose a platform offering competitive rates and follow the best lending practices.

Read More: An Overview About FHA Loans