Empower Your Wallet: The Power Of Auto Refinance In Financial Planning

Every dollar is significant in the domain of personal finance. From budgeting diligently to seeking out smart investment opportunities, individuals are constantly on the lookout for ways to optimize their financial standing. However, one aspect that often goes overlooked is auto refinancing. While it may not be as glamorous as other financial maneuvers, the power of auto refinance in financial planning cannot be overstated.

What Is Auto Refinancing?

Before looking into its significance in financial planning, it’s essential to understand what auto refinancing entails. Essentially, auto refinancing involves replacing your current car loan with a new one, typically with better terms such as a lower interest rate, extended loan period, or both. Whether this results in decreased monthly payments, interest expenses gradually diminish, or both, is contingent upon the specific circumstances of the individual.

Lowering Monthly Payments

One of the primary benefits of auto refinancing is the potential to lower monthly payments. For individuals grappling with high monthly expenses, whether due to unforeseen circumstances or poor initial loan terms, a lower monthly payment can provide much-needed relief. Borrowers can significantly alleviate their financial strain and utilize the additional funds for savings objectives or critical expenditures by obtaining a new loan with a diminished interest rate.

Minimizing Interest Expenses

Another significant advantage of auto refinancing is the opportunity to minimize interest expenses. High interest rates can significantly inflate the overall cost of a car loan, making it imperative for borrowers to seek out more favorable terms whenever possible. Through auto refinancing, individuals can potentially secure a lower interest rate, thereby reducing the total amount of interest paid over the life of the loan. This may result in significant long-term savings, which would enable individuals to reinvest those funds in debt repayment or retirement savings, among other financial goals.

Improving Cash Flow Management

For the pursuit of long-term financial objectives and the maintenance of financial stability, effective cash flow management is vital. By means of auto refinancing, individuals can effectively decrease their monthly payments, thereby enhancing their cash flow management and guaranteeing the availability of adequate funds to meet critical expenditures, accumulate for the future, and allocate towards opportunities that generate wealth. This improved cash flow flexibility can provide a sense of financial security and empower individuals to make informed decisions about their money.

Enhancing Financial Flexibility

Given the unpredictability of life, one’s financial situation could suddenly alter. Whether facing unexpected expenses, job loss, or economic downturns, having financial flexibility is crucial for weathering any storm. Auto refinancing can provide individuals with greater financial flexibility by lowering monthly payments and reducing interest expenses. In times of financial strain, this can make all the difference, allowing individuals to redirect funds towards pressing needs or build up an emergency fund to cushion against future uncertainties.

Incorporating Auto Refinance Into Financial Planning

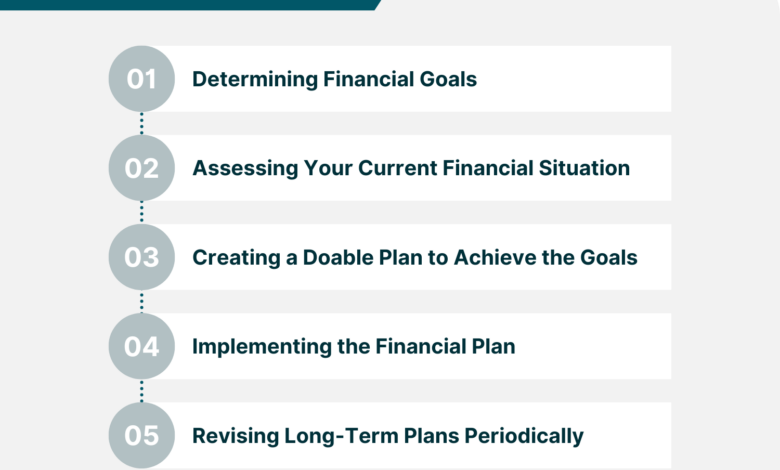

Given its potential to lower monthly payments, minimize interest expenses, and enhance financial flexibility, auto refinancing should be a key component of any comprehensive financial plan. However, it’s essential to approach auto refinancing strategically and assess whether it aligns with your specific financial goals and circumstances. Conducting thorough research, comparing offers from multiple lenders, and evaluating the long-term impact on your finances are critical steps in determining whether auto refinancing is the right choice for you.

Conclusion

In the realm of financial planning, every opportunity to optimize your financial standing should be explored. Auto refinancing represents a powerful tool in the pursuit of financial stability and long-term prosperity. By lowering monthly payments, minimizing interest expenses, improving cash flow management, and enhancing financial flexibility, auto refinancing can empower individuals to take control of their finances and achieve their goals. Incorporating auto refinance into your financial plan can pave the way for a brighter financial future, one where every dollar works harder for you.

Apart from this, if you are interested to know more about TMY Data Assist then visit our Business category