6 Great Tips to Acquire the Most Out of

Last Updated on March 7, 2024 by admin

A VA loan is a mortgage given through the US Veterans Affairs Program. Having a VA mortgage comes with numerous advantages, as it can be guaranteed without putting any money down, and there is no requirement for private mortgage insurance. Getting a home using hard-earned VA loan benefits is one of the most rewarding experiences you will ever get in your life. Compared to other loan types, government-backed mortgages are more flexible and have forgiving requirements. The following are great tips in which you can acquire the most out of your mortgage loan:

1. Understand Occupancy Requirements

VA loans have occupancy requirements which aid underscore the VA’s home loan focus on a primary residence. Within 60 closing days, the US Department expects you to be living in the house. As much as it can be a tall order for military contractors operating overseas, some exceptions come with the occupancy requirements, with the most popular one being the ability of your spouse to fulfill all the requirements on your behalf.

However, this exception can be unfair to the single deployed service members. It is advised to lay out any issues to your loan officer to avoid any inconveniences that may arise in the future.

2. Reliable Income is Key

Your loan officers are interested in seeing a stable and reliable income that is not likely to come to a halt anytime soon. The residual income guidelines vary depending on the geography or family size needing the VA loan. There has to be an acceptable income to debt ratio for you to meet the full requirements and enjoy the VA loans. The debt to income ratio is measured by the amount you have left after sorting out your major monthly expenses.

When it comes to the employment situation, vendors view each one of them differently hence getting them to understand your situation through your explanation is important.

3. Know the Acceptable Uses

The VA commands veterans to use the program to refinance or purchase the primary residence. The units vary from a single-family residence, a manufactured home, a multiunit property, or a modular home so long as you live in any of them. Using the VA loan for the right stated purpose is vital as it makes things less complicated and dictates whether you will be granted the loan or not.

However, you can convert your primary residential home into a residential state after staying in it for a while and following the guidelines without fail.

4. Keep Your Credit Card Clean

Once you place your mortgage application, be careful with how you conduct your finances and credit. During the approval stages, the loan officers take a keen look into your spending ways and bank statements to ensure what they may be getting themselves into. Signs of large deposits and withdrawals into and out of your account qualify to be red flags and may make it difficult for your application to go through.

No new credit should be applied during the loan application process as it can easily lead to being disqualified. You can make any big purchases or investments after the loan is approved.

5. Start Without a COE

When you decide to apply for a loan, ensure you have all the requirements to avoid unnecessary barriers. Not getting your paperwork right is one such barrier. Your Certificate of Eligibility is not important in the initial stage as lenders will always get it for you during the preapproval process. Not having a COE should be the least of your worries when placing a VA home loan application.

However, important documents such as bank statements and application forms should be in place to ensure the whole process is seamless and stress-free.

6. Find a VA Approve Home

Before investing your finances in a mortgage, it is important to make sure the condos you are aiming at are VA-approved homes. To know whether a home is VA-approved, ask the lender involved to determine the approval status or check the current list of VA approved homes. The listings for VA homes are one by the local listing agents via the Multi Listing Systems.

Veterans have more access to powerful mortgage options, and taking advantage of the opportunity while it is still available makes a big impact on your life.

The VA Loan minimum property requirements are adequate roofing, safe and easy to operate mechanical systems, adequate heating systems, and no leakage signs. As a veteran, the process gets easy once the lender knows your eligibility for a loan under the veteran status. In case of any problems with your credit card, contact the credit card bureau to rectify any mistakes that may make your application and approval harder.

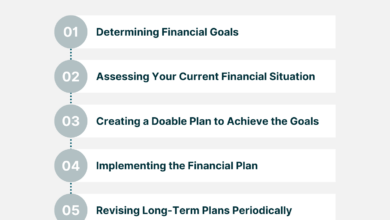

Maximizing the Benefits of Your VA Home Loan: 6 Great Tips

If you’re a veteran, getting a VA home loan can be a great way to achieve the American dream of homeownership. Not only are VA loans easier to qualify for than conventional loans, but they also come with several unique benefits, such as no down payment requirement and no private mortgage insurance. However, to make the most out of your VA home loan, there are certain things you need to keep in mind. Here are six great tips to help you maximize the benefits of your VA home loan:

First, understand the occupancy requirements. VA loans are designed for primary residences, meaning you must live in the house within 60 days of closing. Suppose you’re a military contractor operating overseas. In that case, there are exceptions, but it’s best to talk to your loan officer about your situation.

Second, make sure you have a reliable income. Your loan officer will want a stable and reliable income to ensure you can meet the loan requirements. The debt-to-income ratio is critical in determining your eligibility for a VA home loan, so ensure you have all your financial documents in order.

Third, know the acceptable uses of your VA loan. The VA loan is meant to purchase or refinance your primary residence, which can be a single-family home, a multi-unit property, or a modular home, as long as you live in it. Make sure you’re using the loan for its intended purpose to avoid complications.

Fourth, keep your credit clean. Loan officers will scrutinize your finances and credit history during the approval process. Avoid applying for new credit or making big purchases that can raise red flags during the process.

Fifth, don’t worry about the COE. While the Certificate of Eligibility is important, your lender can obtain it during preapproval. Make sure you have all the necessary paperwork to streamline the process.

Finally, find a VA-approved home. Not all homes are eligible for a VA loan, so make sure you’re looking at properties that have been approved. Check with your lender or local listing agents to get the latest list of VA-approved homes.

By following these six tips, you can maximize the benefits of your VA home loan and achieve your dream of homeownership.

Read More: An Overview About FHA Loans